This week is America Saves Week, a time to focus on actions Americans can take to successfully save. When it comes to saving for retirement, Americans are feeling pessimistic.

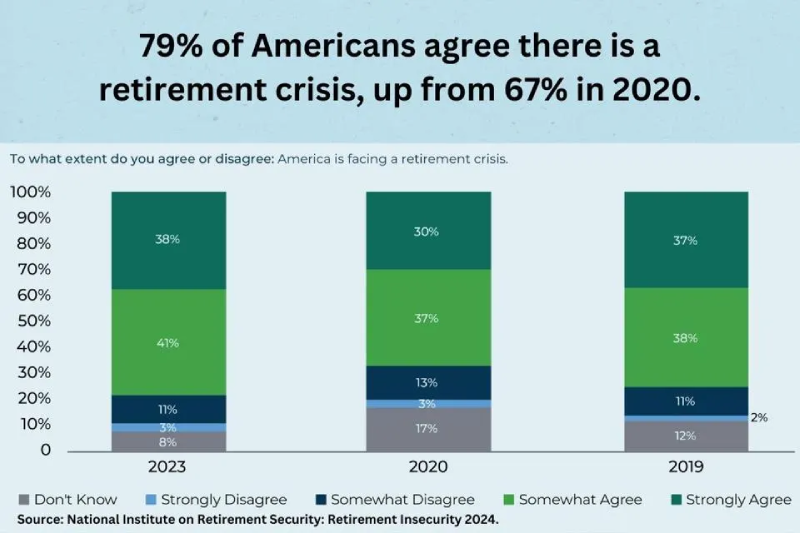

In a recent nationwide survey of working age Americans, 79% agree that the nation faces a retirement savings crisis, up from 67% in 2020.And more than half of Americans (55%) are concerned that they cannot achieve financial security in retirement.

But is this worry about retirement savings warranted? After all, people worry about many things, and some worries are not necessarily justified. For example, up to 40% of Americans say they are worried about flying. But data show that aviation is the safest mode of transportation, and travelers are far more likely to get into a car accident on the way to the airport than to have any kind of serious trouble on a flight.

When it comes to retirement, the data indicate that Americans’ worries indeed are justified. The reality is that retirement security is out of reach for far too many Americans. Most Americans, particularly middle-class workers, are falling far short when it comes to saving enough money for a financially secure retirement. According to the National Retirement Risk Index, half of U.S. households will not be able to maintain their standard of living when they retire even if they were to work until age 65 and annuitize all their financial assets.

A Grim Outlook For the Generation X

Take for example Generation X, the generation that quickly is approaching retirement age and was the first generation to mostly enter the workforce following the shift from defined benefit (DB) pensions to 401(k)s and other defined contribution (DC) plans in the private sector. For Gen Xers (those born between 1965 and 1980), the bottom half of earners have only a few thousand dollars saved for retirement. While the typical Gen X household has an average savings of more than $243,000, the median household has only $40,000 in retirement savings.